People with low salaries often have a question whether they are eligible to get a personal loan. Even if your monthly income is ₹16,000, you can get a personal loan from many banks and financial institutions. Let us know how much loan you can get in this salary range and how you can apply online

How much personal loan can I get on a salary of ₹16,000?

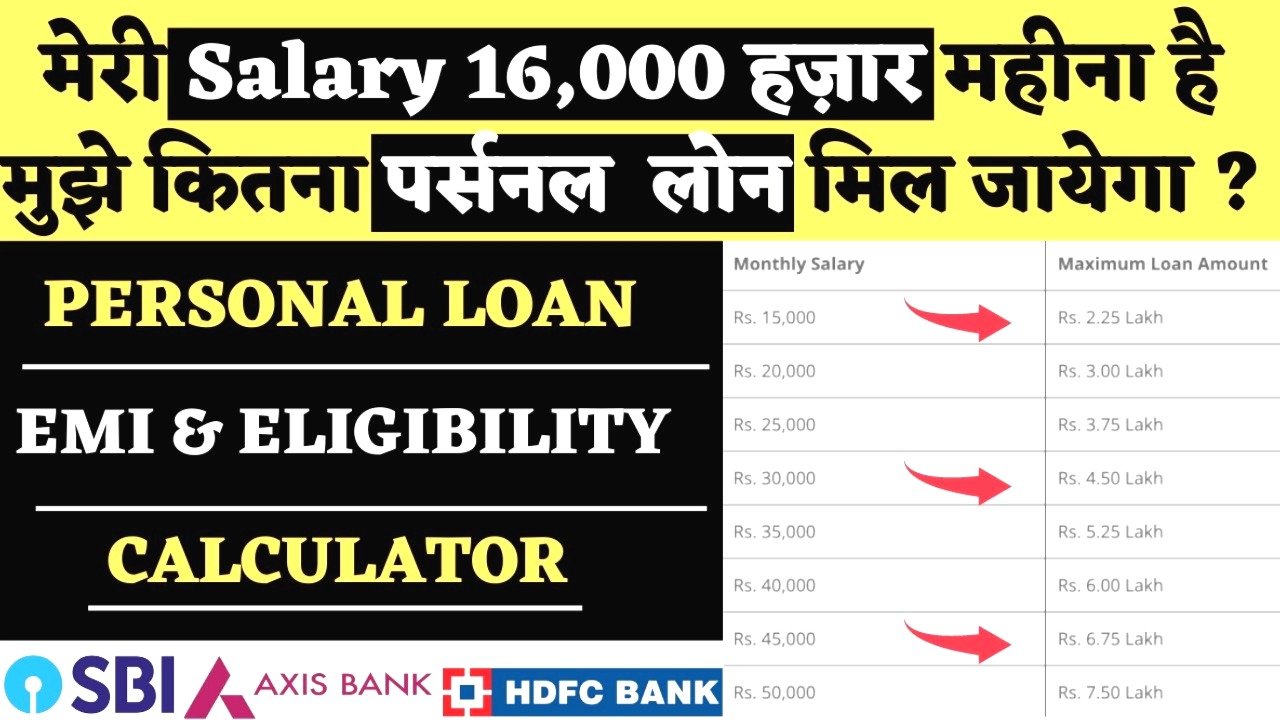

Banks generally accept 50-60% of your monthly income as EMI. On a salary of ₹16,000, your monthly EMI can be around ₹8,000-9,600. Assuming a loan tenure of 5 years and an interest rate of 10-15%, you can get a personal loan in this EMI range of ₹4 lakh to ₹5.5 lakh. However, this amount depends on the bank’s policies, your credit score and existing loan. Some banks also offer special schemes for low income people in which small amount loans are available at low interest rates

Top banks that give personal loan on salary of ₹ 16,000

Many leading banks and financial institutions offer personal loans to low-income individuals. Institutions like SBI, HDFC Bank, ICICI Bank, Bajaj Finance and Kotak Mahindra Bank offer personal loans even for salaries up to ₹16,000. Some of these banks offer loans ranging from a minimum of ₹25,000 to a maximum of ₹5 lakh. The interest rates of these banks start from 10.5% and can change depending on your credit score. Some banks also give special discounts to women which reduces their interest rates

Complete process of online application

Applying for a personal loan online is very simple. First, visit the official website of the bank of your choice and click on the ‘Apply Now’ button in the ‘Personal Loan’ section. Fill in the form with your personal information, employment details and income related information. After this upload the scanned copies of the required documents which include Aadhar Card, PAN Card, Salary Slip and Bank Statement. Most banks have an EMI calculator tool where you can enter your salary to know how much loan you are eligible for. After submitting the application, the bank will check your documents and approve the loan within 24 to 72 hours

Requirements for loan approval

To get a personal loan for a salary of ₹ 16,000, you have to keep some things in mind. First of all your CIBIL score should be 650 or more. Second, you must have a stable job – at least 1 year of job. Third, if you have an existing loan, its EMI should be less than 50% of your total income. Some banks also give loans on the basis of joint income, for this you can make your spouse or any family member a co-applicant. Proof of income is different for self-employed individuals and they need to show ITR and bank statements

Even with a monthly income of ₹16,000, you may be eligible to get a personal loan from many banks. By choosing the right bank, improving your credit score and submitting the right documents, you can get a loan up to ₹5 lakh. The online application process has made this process even easier. Just keep in mind that before taking the loan, assess your repayment capacity correctly and do not let the EMI exceed 50% of your income. Visit the website of a trusted bank and start your personal loan application today